If your QuickBooks Balance Sheet Out of Balance report is showing mismatched totals between assets, liabilities, and equity, you’re not alone. This common issue frustrates many QuickBooks Desktop users who depend on accurate financial data for decision-making. When your QuickBooks balance sheet isn’t balancing, it often indicates data corruption, journal entry errors, or a problem in your company file setup. For quick professional assistance, you can call +1(866)500-0076 to connect with certified QuickBooks experts who can help fix this issue efficiently.

A balance sheet discrepancy in QuickBooks means that the accounting equation — Assets = Liabilities + Equity — is not holding true. This can lead to inaccurate financial reporting and confusion during audits or tax preparation.

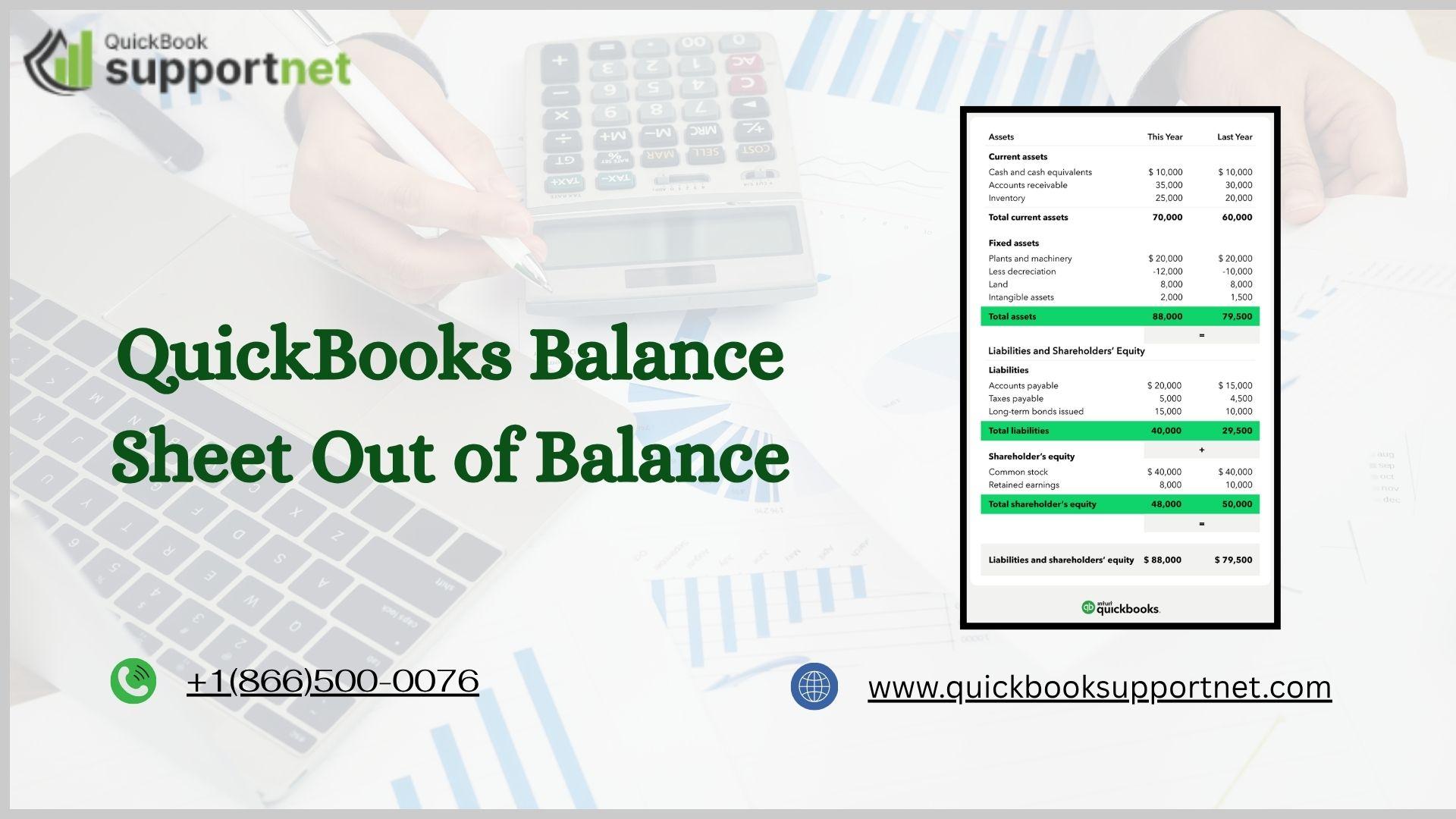

Is your QuickBooks Balance Sheet out of balance? Discover causes, fixes, and expert support to restore financial accuracy fast.

Common Causes of QuickBooks Balance Sheet Out of Balance

QuickBooks balance sheet mismatches can occur due to several reasons. Understanding these causes helps you troubleshoot effectively:

- Data Integrity Problems: File corruption or incomplete transactions may throw off your balance sheet totals.

- Damaged Transactions: Voided or deleted transactions can sometimes leave behind residual data errors.

- Multi-User Conflicts: If multiple users make simultaneous changes to company data, records can become unsynced.

- Incorrect Journal Entries: Wrong entries made to equity or retained earnings accounts may cause the report to be out of balance.

- Custom Filters or Date Ranges: A report set to the wrong date range or filter can show mismatched figures.

Knowing what caused the problem is the first step to fixing it properly.

Step-by-Step Methods to Fix QuickBooks Balance Sheet Out of Balance

Let’s look at the best ways to fix balance sheet discrepancies in QuickBooks Desktop:

1. Run the Verify and Rebuild Data Tool

QuickBooks has built-in tools to check for data integrity issues.

Steps:

- Go to File > Utilities > Verify Data.

- If QuickBooks detects issues, select Rebuild Data.

- Follow the prompts to repair the company file.

- Once done, run the balance sheet report again to check if it balances.

2. Check for Damaged Transactions

Sometimes, corrupted transactions are the root cause of imbalance.

Steps:

- Open Reports > Company & Financial > Balance Sheet Summary.

- Change the report’s date range to All Dates.

- Identify the date the balance sheet went out of balance.

- Look for transactions created, deleted, or voided on that date.

3. Compare Accrual vs. Cash Basis Reports

Balance sheet discrepancies can differ between accrual and cash basis reports.

Steps:

- Run both versions of the balance sheet.

- If one balances and the other doesn’t, the issue lies in transaction timing or applied payments.

4. Run the QuickBooks Rebuild Data Tool

If the error persists, use the Rebuild Data Tool again or restore a recent backup.

Steps:

- Go to File > Utilities > Rebuild Data.

- Backup your company file before proceeding.

- Let QuickBooks repair damaged data blocks automatically.

5. Check for Multi-User Mode Conflicts

If using QuickBooks in multi-user mode, ensure all users log out and run Verify Data again. Conflicting entries can lead to out-of-balance reports.

Preventing QuickBooks Balance Sheet from Going Out of Balance

Here are best practices to keep your QuickBooks reports accurate:

- Backup Regularly: Maintain daily or weekly backups of your company files.

- Rebuild Data Frequently: Use Verify and Rebuild every month to prevent file corruption.

- Limit Multi-User Editing: Coordinate data entry tasks among team members.

- Avoid Forced Deletions: Always use QuickBooks tools to void transactions instead of manually deleting them.

- Update QuickBooks Desktop: Ensure your software is updated to the latest release.

Following these steps can help prevent recurring QuickBooks balance sheet discrepancies and keep your financial data accurate.

When to Contact an Expert

If your QuickBooks balance sheet not balancing issue persists after trying all the steps above, you may be dealing with deeper company file corruption. In that case, professional assistance is highly recommended.

You can reach certified QuickBooks support experts at +1(866)500-0076 for personalized troubleshooting. They can repair your company file, restore lost data, and ensure all financial reports are accurate again.

Conclusion

A QuickBooks Balance Sheet Out of Balance can cause serious reporting inaccuracies and confusion in financial management. Whether it’s due to file corruption, data errors, or multi-user conflicts, you can often resolve the issue using QuickBooks’ built-in tools like Verify Data and Rebuild Data. Maintaining good data hygiene and regular backups will prevent these problems in the future.

If your balance sheet still doesn’t match or you’re unsure about performing repairs, call +1(866)500-0076 for expert QuickBooks support. Getting professional help ensures your reports are accurate, compliant, and ready for audits or financial planning.

FAQs

Q1. Why is my QuickBooks balance sheet not balancing?

It’s usually caused by corrupted transactions, data file damage, or incorrect filters in your report settings.

Q2. Can the Rebuild Data Tool fix all out-of-balance errors?

It can repair most data corruption issues, but severe cases may need advanced file recovery.

Q3. How often should I run Verify Data in QuickBooks?

It’s best to run it monthly to detect and repair potential data issues early.

Q4. What if my balance sheet is out of balance only on one date?

That indicates a damaged or edited transaction on that specific date. Reviewing those transactions can fix the issue.

Q5. Who can help me fix QuickBooks balance sheet discrepancies?

You can call +1(866)500-0076 for professional QuickBooks troubleshooting and data recovery assistance.

Read Also: QuickBooks Error 15243