IMARC Group has recently released a new research study titled “South Korea Cosmetic Surgery Market Report by Procedure (Surgical Procedures, Non-Surgical Procedures), Gender (Female, Male), Age Group (13 to 29, 30 to 54, 55 and Above), End User (Ambulatory Surgical Facility, Hospitals and Clinics, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Cosmetic Surgery Market Overview

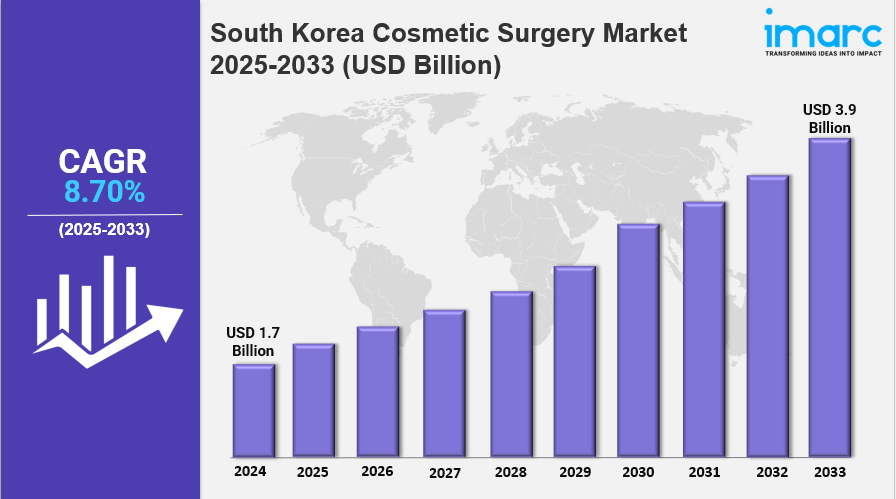

The South Korea Cosmetic Surgery Market size was valued at USD 1.7 Billion in 2024 and is projected to reach USD 3.9 Billion by 2033. The market is expected to grow at a CAGR of 8.70% from 2025 to 2033. Increasing technological advancements, the rising cultural emphasis on self-improvement, and the growing demand for minimally invasive procedures and medical tourism are driving this growth.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Cosmetic Surgery Market Key Takeaways

- Current Market Size: USD 1.7 Billion in 2024

- CAGR: 8.70%

- Forecast Period: 2025-2033

- Technological advancements and improved surgical techniques enhance safety and effectiveness, boosting South Korea as a preferred destination for cosmetic surgery.

- Increasing demand for minimally invasive procedures and easy availability of financing options fuel market expansion.

- The Seoul Capital Area leads in advanced techniques and research; Yeongnam attracts medical tourists with high-volume procedures.

- Challenges include high costs and limited access for some demographics, though financing and service expansion offer growth opportunities.

- Growing international patient influx, with over 600,000 reported in 2023, highlights South Korea’s role as a major medical tourism hub.

Sample Request Link: https://www.imarcgroup.com/south-korea-cosmetic-surgery-market/requestsample

Market Growth Factors

South Korea’s cosmetic surgery market is driven by significant technological advancements and surgical innovations. These enhancements improve safety and efficacy, attracting international clients and solidifying the country’s reputation as a leading cosmetic surgery destination. Advancements in microsurgery and eyes-display technology enhance precision and outcomes, thus fueling market growth.

The rise in cultural emphasis on self-improvement and aesthetic enhancement contributes strongly to market expansion. Increasing acceptance of medical tourism, particularly by patients from Japan, Taiwan, and neighboring countries, combined with South Korea’s affordable prices and advanced procedures, has led to over 600,000 international patients in 2023, underscoring the market’s vibrant growth prospects.

The market is also witnessing growing popularity of minimally invasive and non-surgical cosmetic procedures such as botulinum toxin injections, hyaluronic acid fillers, and photo rejuvenation. These procedures, characterized by shorter recovery times and lower costs, expand accessibility and attract younger and older demographics alike. Innovations in anti-aging cosmetic solutions, including biomaterial technologies, cater to the aging population, driving further demand.

Market Segmentation

- Procedure:

- Surgical Procedures:

- Breast Augmentation: Popular surgical enhancement for breast size and shape, widely chosen among females.

- Liposuction: Surgical fat reduction technique targeting body contouring.

- Eyelid Surgery: Common aesthetic procedure to alter eyelid shape and appearance.

- Abdominoplasty: Surgical tummy tuck procedure to improve abdominal appearance.

- Rhinoplasty: Surgical reshaping of the nose, favored among younger age groups.

- Others: Includes additional surgical cosmetic interventions.

- Non-Surgical Procedures:

- Botulinum Toxin: Minimally invasive injections widely used for wrinkle reduction.

- Hyaluronic Acid: Fillers applied for volume restoration and wrinkle treatment.

- Hair Removal: Cosmetic procedures aimed at reducing unwanted hair.

- Nonsurgical Fat Reduction: Non-invasive fat removal techniques.

- Photo Rejuvenation: Light-based therapy to enhance skin appearance.

- Others: Additional non-surgical cosmetic treatments.

- Gender:

- Female: Women commonly opt for procedures like double eyelid surgery and rhinoplasty.

- Male: Men increasingly seek facial contouring and anti-aging treatments.

- Age Group:

- 13 to 29: Younger demographic favoring procedures like rhinoplasty and double eyelid surgery.

- 30 to 54: Middle-aged individuals preferring anti-aging treatments including facelifts and Botox.

- 55 and Above: Older group opting for advanced facial rejuvenation procedures.

- End User:

- Ambulatory Surgical Facility: Medical facilities providing outpatient cosmetic surgeries.

- Hospitals and Clinics: Larger healthcare facilities offering comprehensive cosmetic procedures.

- Others: Other venues where cosmetic surgery services are provided.

- Region:

- Seoul Capital Area: Hub for advanced cosmetic surgery techniques and research; attracts many international clients.

- Yeongnam (Southeastern Region): Specializes in high-volume surgical procedures; popular among medical tourists.

- Honam (Southwestern Region): Focuses on natural and minimally invasive surgical methods.

- Hoseo (Central Region): Supports smaller clinics and innovation in cosmetic surgery technology.

- Others: Regions offering specialized services with local and traditional beauty practices.

Regional Insights

The Seoul Capital Area dominates the South Korea cosmetic surgery market, being renowned for cutting-edge techniques and research that attract numerous international patients. Alongside, Yeongnam is noted for high-volume procedures and medical tourism. This concentration of advanced services in these regions highlights their leadership in driving market growth across South Korea.

Recent Developments & News

- May 2024: South Korean startup MediThinQ launched its SCOPEYE 3D microsurgery solution featuring eye-display technology aimed at improving precision across medical specialties.

- May 2024: The Ministry of Health and Welfare reported over 600,000 international patients in 2023, with notable expansion in dermatology and plastic surgery services, reinforcing South Korea’s position as a medical tourism hub.

- January 2024: CG Bio expanded into the U.S. market, leveraging its biomaterial technologies for anti-aging and aesthetic procedures.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302