IMARC Group has recently released a new research study titled “ South Korea Craft Beer Market Report by Product Type (Ales, Lagers, and Others), Age Group (21-35 Years Old, 40-54 Years Old, 55 Years and Above), Distribution Channel (On-Trade, Off-Trade), and Region 2025-2033. ”, offering a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Craft Beer Market Overview

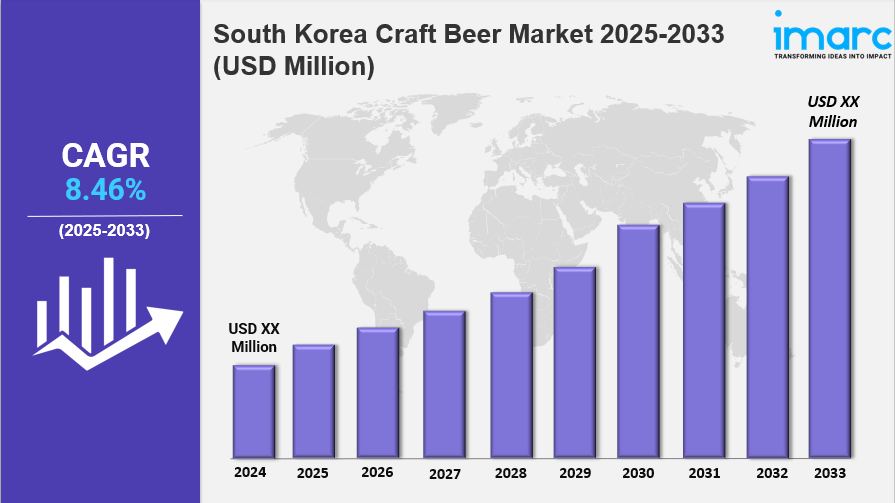

The South Korea craft beer market size is projected to grow at a CAGR of 8.46% during the forecast period 2025-2033, supported by increasing consumer demand for unique flavors, rising disposable incomes, and a growing number of microbreweries. Favorable government regulations and the influence of global craft beer trends also drive market expansion. The market size was valued at USD 4,500 million in the base year 2024. This report provides an in-depth analysis of market trends, drivers, and segments.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Craft Beer Market Key Takeaways

- Current Market Size: USD 4,500 million in 2024

- CAGR: 8.46% (2025-2033)

- Forecast Period: 2025-2033

- Increasing consumer preference for diverse and unique beer flavors drives growth with craft breweries offering innovative beers.

- Inflating disposable income and the proliferation of microbreweries and brewpubs in urban areas foster a vibrant craft beer culture.

- Breweries experiment with local ingredients and unconventional flavors to satisfy adventurous consumers.

- Changing consumer preference towards healthier living fuels development of low-calorie and low-alcohol craft beer varieties.

- Supportive government regulations, including tax reform and licensing, encourage market expansion despite some stringent requirements.

Sample Request Link: https://www.imarcgroup.com/south-korea-craft-beer-market/requestsample

Market Growth Factors

The South Korean craft beer market is driven mainly by increasing consumer preference for diverse and unique flavors. Craft breweries in the country cater to this demand by offering a variety of innovative and artisanal beers like India Pale Ales, stouts, sours, and seasonal specialties. This shift is bolstered by the influence of global beer culture that promotes experimentation and diversity in brewing. Younger consumers especially seek craft beers that provide unique sensory experiences, fueling rapid adoption and market growth.

Another strong driver is the rise in disposable incomes accompanied by the growth of microbreweries and brewpubs, particularly in urban areas such as Seoul, Busan, and Jeju Island. The number of microbreweries increased significantly, with data showing growth from 58 in 2014 to 85 in 2016. These small-scale breweries foster a vibrant community culture by offering fresh beer directly to consumers and creating social hubs where beer lovers congregate to sample brews and engage with brewers.

Government support is also playing an essential role in expanding the South Korea craft beer market. Recent tax reform has lowered the financial burden on small breweries, facilitating easier market entry. The government has set high entry barriers for obtaining a regular brewing license that allows off-premises retail and wholesale distribution, requiring minimum fermentation and holding tank capacities of 250,000 liters and 500,000 liters respectively. These measures drive market size growth despite the challenges posed by stringent regulations and production costs.

Market Segmentation

Breakup by Product Type:

- Ales: Broad category of craft beers fermented at warmer temperatures with top-fermenting yeast, resulting in robust, complex flavors. Popular types include pale ales, IPAs, stouts, and porters noted for fruity and spicy notes.

- Lagers: Fermented with bottom-fermenting yeast at lower temperatures for a cleaner, crisper taste. Includes pilsners, helles, and bocks favored for their refreshing and soft qualities.

- Others: Not specifically detailed but includes other craft beer variants outside ales and lagers.

Breakup by Age Group:

- 21-35 Years Old: Key drivers attracted by unique flavors, social drinking, and cultural trends supporting local products. Highly engaged with digital media.

- 40-54 Years Old: Appreciate quality and craftsmanship, have higher disposable incomes, seeking sophisticated drinking experiences.

- 55 Years and Above: Growing interest appreciating artisanal qualities and variety. Prefer moderate alcohol and balanced flavors, often enjoying beer in relaxed social settings.

Breakup by Distribution Channel:

- On-Trade: Consumption within bars, restaurants, pubs, and hotels providing social, experiential settings with fresh beer on tap, encouraging repeat visits.

- Off-Trade: Purchase from retail outlets like supermarkets, liquor stores, and online for home or private consumption, offering convenience and variety.

Breakup by Region:

- Seoul Capital Area: Economic and cultural hub with vibrant craft beer scene, numerous microbreweries, festivals, and cosmopolitan population driving demand for innovative products.

- Yeongnam (Southeastern Region): Industrial powerhouse with growing craft beer market fueled by tourism and local breweries, coastal cities like Busan notable.

- Honam (Southwestern Region): Known for cultural heritage and culinary traditions; growth through focus on local ingredients and traditional brewing.

- Hoseo (Central Region): Educated consumer base interested in artisanal and innovative brewing, with collaborations between breweries and research institutions.

- Others: Additional regions contributing to overall market growth.

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=21004&flag=C

Regional Insights

The dominant region is the Seoul Capital Area, encompassing Seoul and surrounding cities, recognized as South Korea's economic and cultural hub. This region hosts numerous microbreweries, brewpubs, and craft beer festivals. The affluent and diverse population drives demand for premium and innovative craft beers, establishing Seoul Capital Area as the leading market contributor in the country.

Recent Developments & News

In May 2021, Jeju Beer Co., South Korea’s leading craft beer maker, announced its aim to become one of the country's top four breweries by the end of 2022. CEO Moon Hyuck-ki stated the company planned to use proceeds from its initial public offering to enhance operations and expand market presence, signaling strategic growth and investment for increased market share.

Key Players

- Jeju Beer Co.

- Other local breweries and established domestic beer companies (specific names not provided)

Competitive Landscape

The competitive landscape is characterized by a dynamic mix of small local breweries, innovative brewpubs, and established domestic beer companies entering the craft segment. Local breweries are prominent players, focusing on artisanal brewing techniques and locally sourced ingredients. Larger breweries are launching craft-style beers, while collaboration among breweries fosters innovation and diversity.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, considerations studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302